Our Head of Brand Partnerships, Dominic Wren, caught up with Tony Craddock, Director General of the Payments Association, to learn about the reason behind the rebrand, and bringing together a potentially fractured payments world.

Previously known as the Emerging Payments Association, the 225-member global organisation for financial players large and small have spent the last 12 months reworking and rebranding. After a decade of acting as a hub for payments businesses and individuals alike, the team decided that it was time to make the jump to a different brand.

Compared to their previous brand, it’s clear to see the changes – a modern typeface, a sleeker logo, carefully walking the line between something that could be mistaken for the latest payments start-up and a long-standing institution. It reflects their changing representation of their own audience and seeks to project that back to them.

Dom: “Going back to the start of this rebrand project, what was the first seed of an idea to do this?”

Tony: “We’ve always wanted to make being in this industry more rewarding, for the businesses and the individuals. Previously, there was a specific trade body for payments, so we took up the role of prepaid or ‘emerging’ payments – however, 6 or 7 years ago, that trade body merged into ‘UK Finance’, and ever since, there’s been a gap. There was an open seat at the table in the finance space for a body that would represent all businesses within payments.

We realised that there was nobody better suited to take up a seat at that table than us, but we were keen to do it at the right time. During a conversation with the incumbent and new chair of our advisory board (Andrea Dunlop of The Access Group and Marion King of NatWest) we decided that not only were we ready, but the industry was calling out for us to take that seat.”

The rebrand reflects not only that ‘seat at the table’ for payments businesses, but also the need for a unifying force within what’s often considered to be a fractured industry. Unlike other financial bodies, the Payments Association doesn’t split by institutions or size of business – looking at their membership body, you’ll find challenger fin-techs alongside crypto trading platforms alongside UK banking institutions.

Download: The (Re)Brand Workbook

Tony: “It’s very purposeful that our imagery includes the bridge – our business cards feature the millennium bridge because that’s what we want to represent – our community acts as a bridge between the old and the new, the big and the small, the cheeky upstarts and the cautious established businesses, the UK and international. We want to make it easy for people to cross that bridge. We dropped the ‘emerging’ because it’s no longer necessary as we want to present ourselves as the location for payments businesses to convene.”

Dom: “Do you think that this rebrand is reflecting the industry itself? Even 6 months ago you would refer to businesses like Monzo or Starling as ‘challengers’, but those lines are quickly blurring. Is there a need to stop using dividers like this as businesses grow?”

Tony: “Yes, the payments industry is unique. To succeed, you must collaborate, despite there being so much competition. Our brand has to represent a wide variety of businesses – we have to be contemporary and modern, but also warm and safe. That can be tricky, and we had to be careful not to be too ‘zappy’ and modern. You can see from the strong black and white of the logo, the way the P and the A almost look like two eyes looking out at you, it feels like a safe but visionary place to belong.”

Dom: “And alongside that visual identity, there’s a new brand purpose attached to the Payments Association.”

Tony: “Yes, it took a long time to work on our brand purpose because it’s not just about our members. We have three other really important stakeholder groups; our advisory board, our individual consultants that act as ambassadors to the association, and then there’s our own staff who absolutely live and breathe our brand.

"Our purpose ended up as this: To empower the most influential community in payments, where connections, collaboration and learning shape an industry that works for all. "

Each component of that purpose is crucial because it’s not just about benefiting our members, it’s about influencing the industry in a positive way that will eventually benefit everyone, right to those that actually make payments day to day.”

Creating a brand that resonates with your audience, however, can be just about defining who it isn’t for, as for who it is (see this piece from Giles Thomas of Mimo Brands for more), and that’s something the Payments Association have had to work on organically over the decade they’ve been growing. From a niche ‘pre-paid’ membership organisation of 15 to a global organisation with off-shoots in the EU and Asia, retaining a defined identity has been crucial.

Tony: “The important thing for us is ensuring that we still represent the niche members, even as we become a global organisation. We have local chapters that are incredibly targeted, and when you see our research, you’ll notice that we have some incredibly niche topics covered. So, it’s not so much about excluding particular businesses as it is about ensuring that every member feels that they’re well represented.”

Dom: “It’s something that you do see within financial media that different streams of the finance world are ‘at war’ with one another – for example when you hear about crypto and challenger banks vs institutions and regulations. It can sometimes be hard to remember that these businesses are actually all under the same umbrella”.

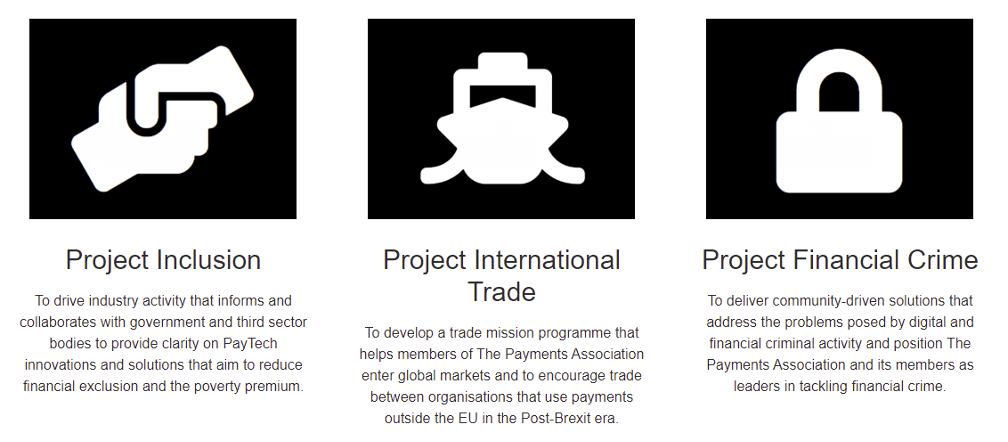

Tony: That’s exactly what we’re seeking to do. There are so many issues that cannot be solved without the industry being more unified – for example when it comes to financial crime. If that issue isn’t addressed, what will happen is consumers at large will start to distrust payments, so what we do is bring together businesses from all corners of the payments space to address these challenges together. In this case we are doing this at a new in person conference called Financial Crime 360, as well as a stakeholder group called Project Financial Crime. That kind of united front is so necessary for ensuring that we don’t lose out as an industry overall.

In a space as fast-moving and competitive as payments, it can be hard to stand out and make a name for yourself. However, this project seems to demonstrate a rebrand that’s truly based on organic growth and understanding of their community. What the Payments Association is seeking to do with this rebrand isn’t just to stick a bold logo on their website; they’re seeking to demonstrate a purpose at both an industry and global level that truly takes the seat at the table they’ve been waiting for.

Rebrand projects are about more than just the look, they’re about reflecting your business in an honest way that connects with your audience – if you’re thinking about updating your brand or starting fresh and need to source support, let us know and we’d be happy to give you some advice on best practice and recommendations.

Get in touch with the GO! Network team